Once you have validated and sized the market for your idea, your next step will be to determine whether this will be a venture or lifestyle business. Financial models can quickly become very complicated, but all models rest on these four main pieces:

- Customer Acquisition

- Sales Mix

- Revenue

- Expenses

The following steps will show you how to create these four sections of your model. If I can advise one thing, it is to try not to second-guess yourself when drafting your initial financial model. It’s best to get your hypotheses down on virtual paper, even if you feel uncertain so that you can start testing them as soon as possible. Remember that it’s much better to fail quickly and adapt rather than fail slowly and miss an opportunity.

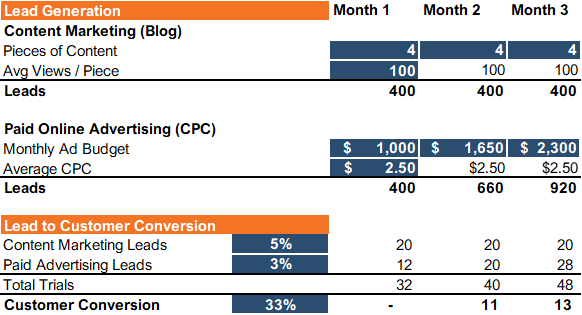

Draft a Sales Funnel

A Sales Funnel is a concept that mathematically connects your leads to your revenue by way of your marketing activities. For example, if you can reach 100 leads per month through cold calls, your sales funnel should be able to tell you how many of those leads convert to paying customers each month.

To start drafting your sales funnel, identify the sales process and engagement channels you want to use to reach your customers, and layout the steps that you can track that a customer takes between lead and customer. Once you have the sales funnel conceptually drafted, it’s time to turn it into number form. In the example sales funnel below, we’re using blog posts and cost-per-click advertising to get leads, which we can track as web visits on our different landing pages; some percentage of those leads are converting to trials, which is easy to track through our website; and some percentage of those trials are converting to paying customers in the month following their trial:

You can see that the blue cells with white numbers are input cells. The white cells with black numbers are calculating off the blue cells. A color-coded system like this can save you and others a lot of headaches.

In this example, my input for Content Marketing is four pieces per month, which I estimate will generate me 400 leads (or views) per piece. My input for Paid Online Advertising is my monthly ad budget, which I’ve decided to increase each month. Dividing the budget by an estimated cost per click gives us our estimated number of leads from that marketing activity. One I have my leads, I need to estimate how many of them from each channel will convert down to the next step in my sales funnel, the trial. Once we have an estimated number of trials, we multiply that by 33% and stagger it one month to incorporate the time it takes to complete a trial and convert to a paying customer.

If you’re still wondering which marketing activities you should be doing and what the steps in your sales funnel are, here’s a tool that can help: Identify & Build a Buying Process.

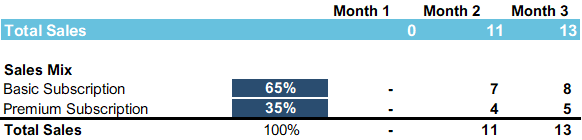

Draft a Sales Mix

Now that you have an estimated number of customers, we need to estimate what they will buy.

At the top of this table are the sales numbers from our marketing activities. Here, we are estimating that 65% of our customers are purchasing the Basic Subscription and 35% the Premium Subscription.

If you don’t have any sales data to help you with your mix percentages, don’t be afraid to take your best guess and revise it later.

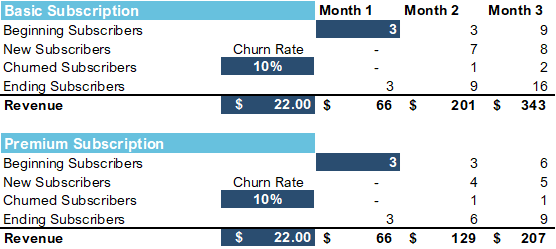

Draft Your Revenue Builds

Now that we have our sales split by what the customers are estimated to buy, we can start figuring out how much revenue this means and when. For a revenue stream that involves one-time sales, this math is very simple – multiply sales by their different prices. However, in our example, we have a subscription-based business, which requires us to keep an ongoing count of our number of subscribers at their two different levels.

Subscription revenue builds start with how many subscribers you have at the beginning of the month. Then, we add how many new subscribers signed up. Next, to account for the fact that subscribers don’t stick around forever, we subtract how many subscribers churned, or canceled their subscriptions. In our example, this is ~10% of our beginning and new customers per month. Finally, we have our ending subscribers, which we can multiply by our subscription price to get that month’s revenue. Also, one month’s ending subscribers become next month’s beginning subscriber count.

Research Your Expenses & How They Behave

Brainstorm and research all your expected costs associated with building and maintaining your business and products. Expenses are usually divided like this:

- Direct Costs (aka Cost of Goods Sold)

- For tech companies

- Cloud & Hosting

- Customer Success / Account Mgmt

- DevOps (ongoing technical support of the platform once it’s live)

- For non-tech companies

- Direct Labor

- Direct Materials

- For tech companies

- Operating Expenses (for tech & non-tech)

- Sales & Marketing

- Development (to create the product before it’s live)

- General & Administrative

Once you’ve identified your expenses, you’ll need to figure out how they will behave over time. Here are some common ways future expenses are estimated:

- As a percentage of revenue

- On a per-user basis

- As an average monthly expense

- By headcount (overall or in one or more departments)

- Annually, semiannually, quarterly, or bimonthly

Once you’ve finished estimating your expenses, you have the four basic parts of the model. Subtract expenses from revenue and there is your profit or loss for a certain time period.

Throughout this process, you may feel very uncertain, and that’s okay. Take a guess. Choose a number. Then go, get out there, and find out if it’s right or not. Don’t be afraid to succeed or fail fast so you can move on to a better idea.

Ready for more financial projections fun (or stress)? Check out The Fine Art of Financial Forecasting. Looking for more financial projections tips just for your subscription-based business? Watch our video on Best Practices & Common Pitfalls.